Students and Local Experts on: Financial Literacy

Money may talk, but that does not mean all of the people who handle it can speak its language.

Next to English and music, money is another universal language that is essential to understand for everyday life. It is also one of the most difficult to master, particularly for this country and its younger generations who have to deal with the high costs of college.

It begs the question, are teens of these younger generations getting enough preparation to manage their personal finances?

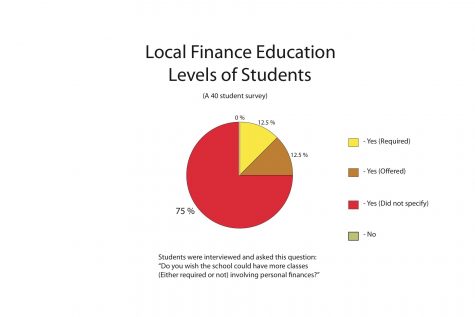

A recent survey asked 40 randomly chosen Hopkinton High School students and town financial experts alike to contribute their thoughts on the current state of financial literacy on local and national levels.

One of topics that the survey covered was the current knowledge and proficiency in financial literacy of the students. Out of those 40 students, 30 specified in their responses that they were either only slightly familiar with or not familiar at all with managing personal finances.

The observations of Economics teacher Steven Spiegel also provide insights that seem to match this statistic. In an interview, he talked about how he thought the school would benefit from an increased emphasis on teaching about personal finances.

“I really do believe that it’s probably one of the most important things for kids leaving high school to understand,” he said, “but it always shocks me how little students know, and they certainly come out (of Economics class) knowing a lot.”

The students who actually take classes such as Economics or perhaps Passages, another finance-related course, may come out learning a lot, but these classes are not a required part of the curriculum, and so the spots are limited as a result.

In fact, according to the 2016 Survey of the States, which was conducted by the Council for Economic Education, only 17 states require high school students to take a course on personal economics. Massachusetts is not one of them. The same survey also says that only 20 out of the 50 states require students to take an economics class, and once again, Massachusetts is not one of them.

“I think it is expected that most people should learn from their parents,” junior Zach Ritterbusch said.

It appears some of the other surveyed students agree with his theory. Senior Janvi Puri said her dad is a banker and he taught her the basics of personal financing from an early age.

“He always teaches me to manage my money wisely,” Janvi said, “and he started teaching me at 8 years old and even now by giving me a debit card.”

Seven other students also said their parents played a role in them learning about self financing.

And that is not all. The Senior Branch Manager at Hopkinton’s Middlesex Bank, Marion Intinarelli, also had similar thoughts.

In response to a question on where she thinks people learn finance management, Intinarelli said, “Well, that is a very difficult question to answer because right now, I work in a community that has a strong financial background and the people that live in this community typically have more resources financially than some other areas. And I find that it kind of goes hand in hand with financial responsibility that they (the parents) raise their children with a little bit more awareness of what finances are.”

Based on that, the Hopkinton community may at least be better off compared to elsewhere in the nation. Classes such Economics or Passages are not required, but they are still offered for those who are interested.

The fact that Hopkinton is primarily made up of families who have the resources to teach their children should the schools not be able to may also help.

However there may be a problem on a national scale if the following evidence is any indication.

The stories about college debt and expenses taking a toll on both incoming and graduating students are numerous, and to a large extent true.

Consider, for example, a study conducted in 2014 by the Brookings Institute. It found that only 52 percent of participating undergraduates could correctly identify what they paid for their first year of college within a $5,000 range.

Financial experts are not invincible either. Before Branch Manager Intinarelli entered the banking business, she said she had her own difficulties when first learning how to manage money.

“I learned in a very poor way. I learned by bad experiences when I was very young. When I was very young and I was 18, I had a credit card that I immediately let get out of control, and it took me a few years to understand that, “ Intinarelli said, “So, I made some big mistakes and it was a long time before I was able to kind of teach myself budgeting, how to handle my money responsibly, and how to make good decisions.”

To avoid similar situations, the biggest impact that can be made on financial literacy may need to happen early on, before finances start to take over the average adult life.

As far as the responsibilities of the school are concerned, Economics teacher Spiegel said there are resources to do more with financial education should more of it be wanted. He said that there are resources available to the school to start new classes.

“I do think for every hour we invest in financial literacy, the long term impact to our society is huge, so as a society, I think we have to make at least an effort to put more into having people leave high school knowing this stuff because it’s gonna be a good investment for our future, for sure.”